Integration Guidelines for Protocols Supporting USDY on Mantle

USDY & mUSD

USDY

USDY (US Dollar Yield Token): USDY is a tokenized note secured by short-term US Treasuries and bank demand deposits. USDY holders receive yield generated from the underlying assets in the form of increasing redemption value (accumulating token). USDY contract is an upgradeable (Transparent Upgradeable Proxy) ERC-20 token. To hold, send, and receive USDY, users should not be on the blocklist (opens in a new tab).

mUSD

mUSD is the rebasing version of USDY, maintaining a consistent peg to $1. Interest is distributed via new token units. Users can swap freely between USDY and mUSD. A swapper UI will be available in October on ondo.finance (opens in a new tab).

mUSD is heavily based on other rebasing tokens such as stETH. Users can acquire mUSD tokens by calling the wrap(uint256) function on the contract. While the price of a single USDY token increases over time, the price of a single mUSD token is fixed at a price of 1 Dollar, with yield being accrued in the form of additional mUSD tokens. Similarly when a user wishes to convert their mUSD to USDY they can call the unwrap(uint256) function, and receive their corresponding amount of USDY.

In order to determine the USD value of the USDY locked in the contract, mUSD will call into RWADynamicRateOracle.sol in order to fetch the current price.

Because mUSD is the rebasing variant of USDY the same transfer restrictions for USDY are also applied to the mUSD token in the beforeTransfer(address,address,uint256) hook.

mUSD rebases daily at 12:00am GMT.

USDY Oracle (RWADynamicRateOracle)

The RWADynamicRateOracle contract is used to post price evolution for USDY on chain. This contract accepts a Range (opens in a new tab) as input from a trusted admin, and will apply the following conversion to the lastSetPrice for a given range:

currentPrice = (Range.dailyInterestRate ** (Days Elapsed + 1)) * Range.lastSetPriceThere is a functionality within the contract that if a range has elapsed and there is no subsequent range set, the oracle will return the maximum price of the previous range for all block.timestamp > Range.end

Integrating USDY into Your Web3 Application

As users may hold USDY or mUSD, a good practice is to support both.

Let's assume a user holds mUSD and wants to supply to your USDY pool.

Option 1: Native integration

The user can directly use his mUSD to interact with your contracts. This means that your contracts will add an extra call to swap from mUSD to USDY before depositing the USDY in the pool.

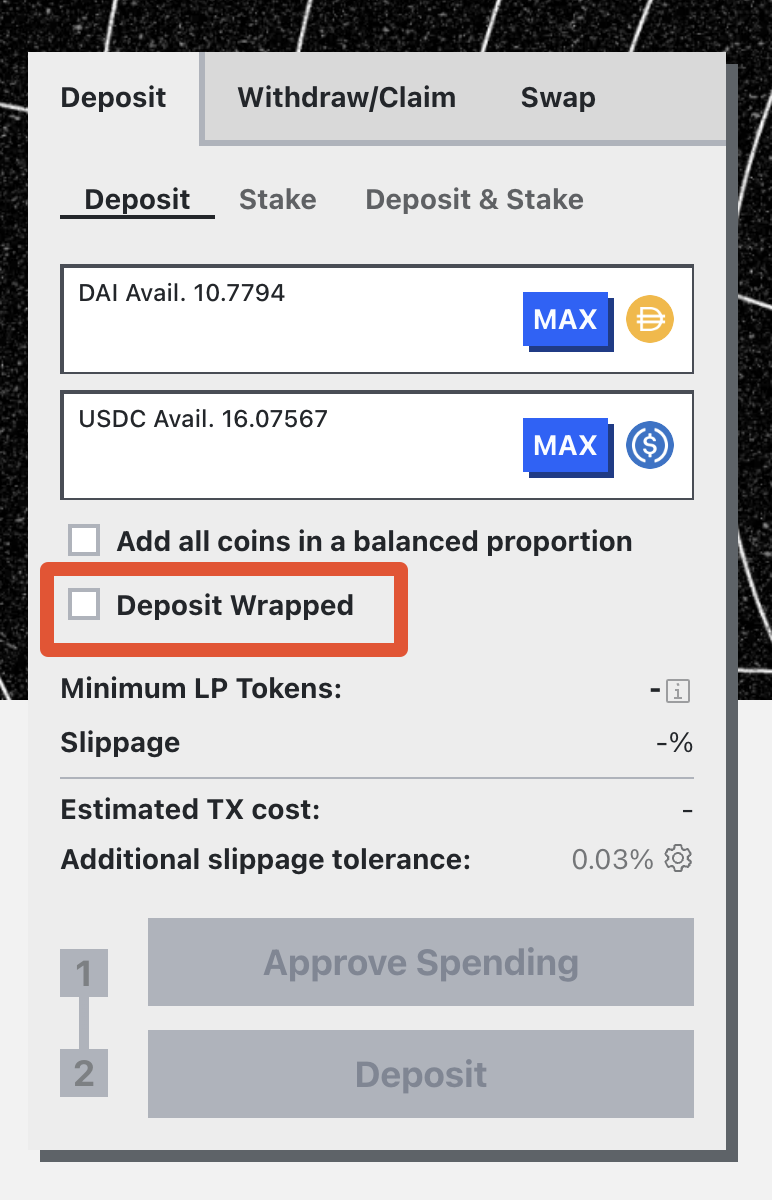

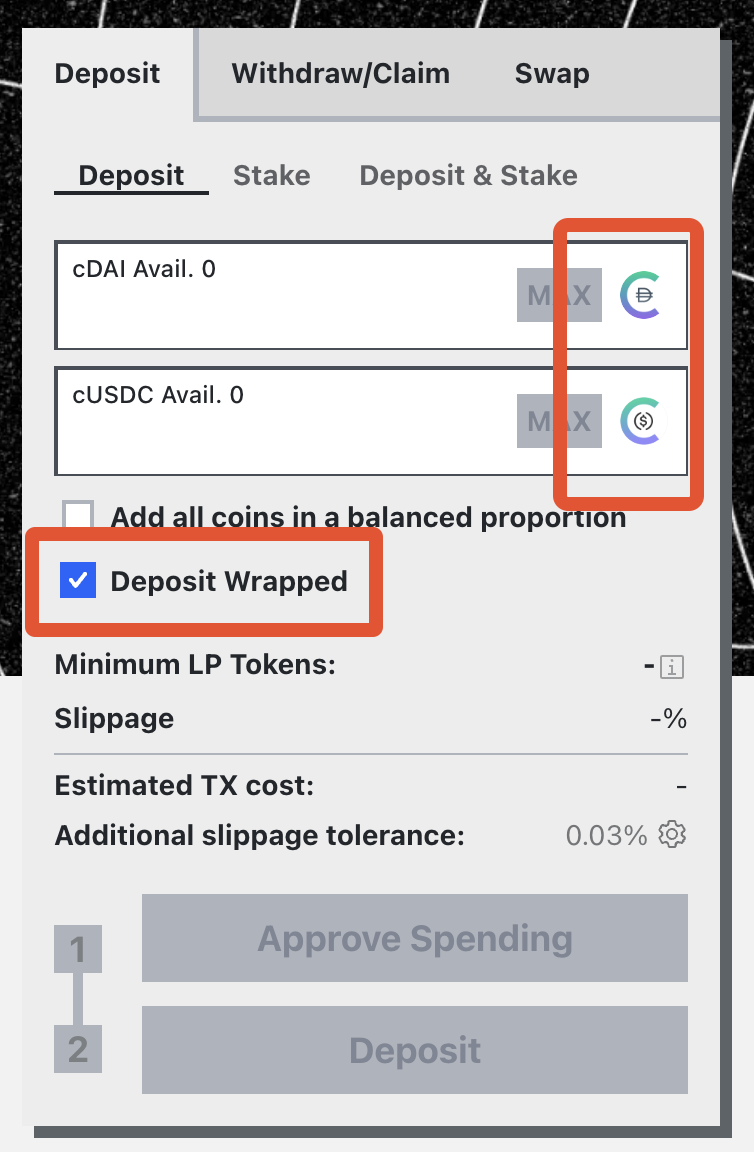

Example of a native integration: Compound pool on curve.fi (opens in a new tab)

Option 2: Informative integration

When trying to supply mUSD, your app informs the user they need to swap to USDY before depositing to the pool: “To supply USDY, you must first swap your mUSD for USDY at ondo.finance (opens in a new tab)”

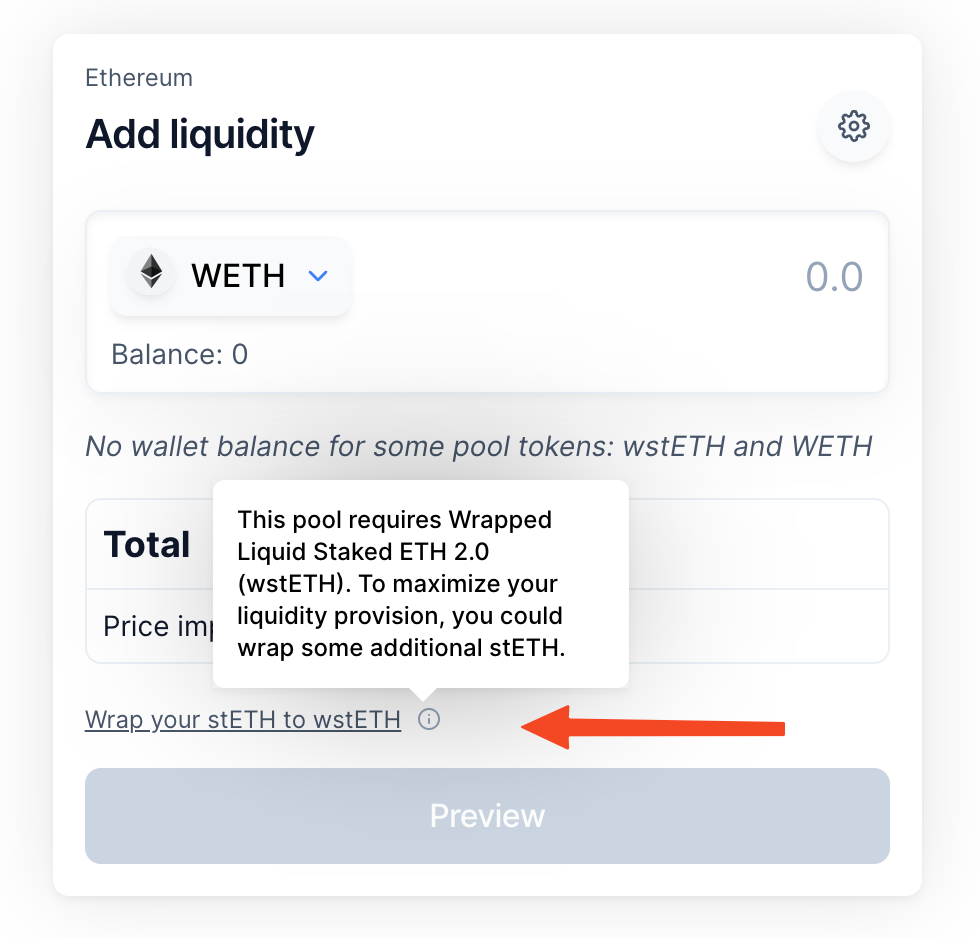

Example of an informative integration: wstETH on Balancer (opens in a new tab)

SmartContracts details

- rUSDY.sol (opens in a new tab) - This contract serves as the backbone for an interest-bearing token where users can

wrap and unwraptheirUSDYtokens to earn interest. It also includes features for access control and address management. - rUSDYFactory.sol (opens in a new tab) - This is a factory contract that allows the deployment of upgradable instances of the

mUSD tokencontract. It is managed by a guardian address, and the deployment process involves creating an implementation contract, a proxy admin contract, and a proxy contract for the token. The code is designed to facilitate the upgradeability of themUSDtoken and includes functions for batched external calls. - RWADynamicOracle.sol (opens in a new tab) - This contract is a dynamic Oracle that provides the price of

USDYbased on configured time ranges and daily interest rates. It also includes mechanisms for pausing and access control to manage the ranges and contract operation. - IRWADynamicOracle (opens in a new tab) - This is an interface that sets a standard for any contract wishing to provide information about the price of

RWA(Asset-Backed Real World Assets) or similar assets. Contracts that implement this interface must provide agetPrice()function that returns the current price ofRWA. The interface does not contain implementation logic but simply establishes a common structure for communication with dynamic asset price oracles.

Resources

- Media Kit (opens in a new tab)

- Contract addresses

- Audits

- USDY github repository (opens in a new tab)

USDY Legal Disclaimer

USDY tokens have not been registered under the US Securities Act of 1933, as amended ("Act") or the securities or financial instrument laws of any other jurisdiction, and may not be offered or sold in the US or to US persons unless registered under the Act or an exemption from the registration requirements thereof is available. The Tokens are offered and sold in the European Economic Area and the United Kingdom solely to qualified investors, and in Switzerland solely to professional clients. Other jurisdiction-based prohibitions and restrictions apply. Ondo Global Markets (BVI) Limited, the issuer of USDY, is not registered as an investment company under the US Investment Company Act of 1940, as amended, or as an Alternative Investment Fund or Undertaking for Collective Investment in Transferable Securities in the European Economic Area, or under the securities or financial instrument laws of any other jurisdiction. Nothing herein constitutes any offer to sell, or any solicitation of an offer to buy, USDY. Nothing herein constitutes investing advice. Acquiring USDY involves risks. A USDY holder may incur losses, including total loss of their purchase price. Past performance is not an indication of future results. Additional terms apply. See docs.ondo.finance/legal/terms-of-service, docs.ondo.finance/general-access-products/usdy and ondo.finance/usdy (opens in a new tab) for details.